Series B of the Week: 8fig

- Manja Munda

- May 14, 2023

- 4 min read

May 8-14, 2023

Heyo 👋

Welcome to my weekly update on startups that raised the most significant Series B funding of the past week. I highlight one US-based startup each week and provide insight into their performance.

While I gather data on investors and investments from Crunchbase, the channel breakdown is based on my own research.

In this weekly snapshot, you’ll get:

A brief introduction to the startup & lead investors

A breakdown of their marketing channels

Three actionable insights you can implement today

Let’s get started!

Series B of the week: 8fig nets $40 million in Series B equity and $100 million in debt

Company name: 8fig

HQ: Austin, Texas

Industry: FinTech

Funded:2020

Series A: $50M, November 2021

Series B announced date: May 9, 2023

Money Raised: $40M

Investors: Koch Disruptive Technologies, Silicon Valley Bank, Battery Ventures, LocalGlobe, Hetz Ventures, Jesselson Capital

8fig provides growth plans and capital to eCommerce sellers to accelerate their growth. With provided capital and plans, sellers can focus on expanding their business instead of worrying about cash flow.

The company only works with established eCommerce businesses that generate more than $100k in annual recurring revenue (ARR).

The website does not provide a clear business model. However, the cost of the growth plan is between $6k-$10k for every $100k included in the plan, but there is no explanation of the cost of capital.

The company uses a typical sales-led growth model. The process starts with a 10-minute questionnaire that produces a tailored offer for the seller, instead of booking a demo.

Honestly, I love these questionnaires because they make it so easy to determine whether you’re a good fit for each other.

Lead investor snapshot: Koch Disruptive Technologies

Koch Disruptive Technologies invests in highly disruptive businesses with the potential to create a new platform or change large existing markets.

The firm is most actively investing in healthcare, supply chain & manufacturing, cyber security, semiconductors, connectivity, fintech, saas and energy transformation.

Number of investments: 59 (45 lead investments)

Exits: 3 (Desktop Metal, Sense Biodetection, DeepCube)

Funding rounds: Diverse (ranging from seed to debt financing, series G and venture round)

8fig’s path to Series B: Marketing channel breakdown

Let’s start by checking the channel distribution on SimilarWeb:

Their best channel is direct, which indicates strong brand recognition. The second best is organic, probably due to a solid content strategy, but let’s examine it further.

Inbound content strategy

Their organic traffic is quite volatile. There was a significant drop after last year’s core update. However, the number of organic pages is increasing, and so is the number of keywords they rank for. Just this year, the number of organic keywords went up from 18 to 41.

This increase could be the result of shifting their content strategy from volume-focused keywords to long-tail, conversion-focused keywords (less traffic but higher intent).

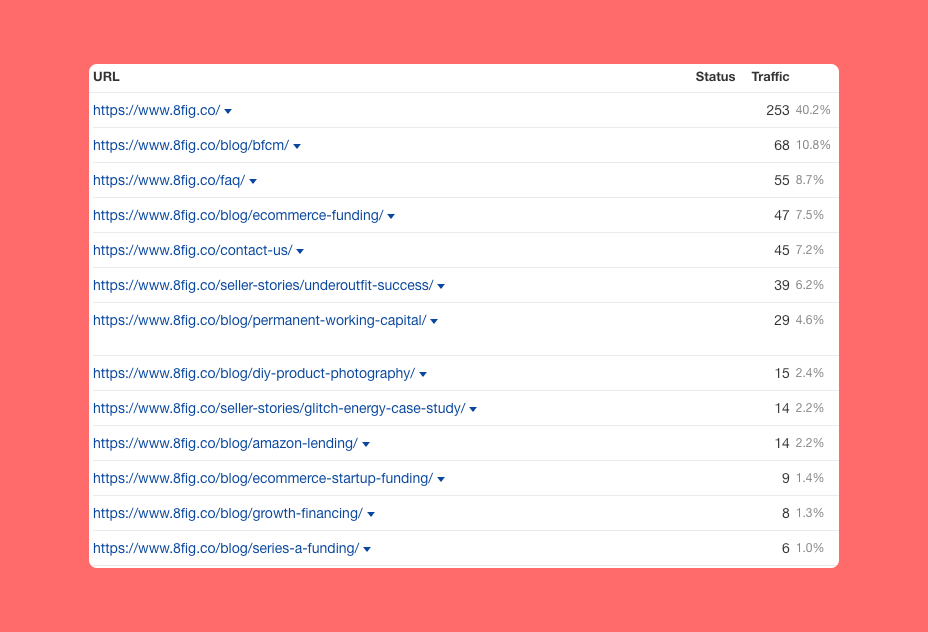

Their top organic pages confirm this shift in content strategy. They used to focus on high volume keywords that didn’t drive any conversions.

For example, their most popular blog post (/blog/bfcm) is about Black Friday/Cyber Monday discounts, which is useful for their target audience but not directly related to their product.

Their top keywords are now “e-commerce startup funding” and “funding for e-commerce businesses” - both with low volume (<100), low difficulty (<15), but directly relevant to 8fig

This overview highlights two things:

Their content strategy has shifted from focusing on generating traffic to increasing conversions by targeting keywords that are directly relevant to their product.

This has resulted in lower traffic, but I am confident they are now receiving more requests for offers.

Paid channels

Paid search

8fig used to run search ads that focused on competitor keywords and category keywords, with dedicated landing pages.

However, according to Ahrefs, none of the ads are currently live.

Paid LinkedIn campaigns

8fig is running ads to their product sign up/offer creation page. The tone/style of ads is conversational and intriguing.

Facebook ads

Similar to LinkedIn ads, Facebook ads are driving traffic to the offer page. The messaging is a bit different though. It’s split between Shopify store owners and Amazon sellers.

In both cases, the visuals are short videos.

The 2 biggest takeaways from their paid channels are:

Since 8fig is a recognizable brand within its category, it is valid to assume that they are leveraging ads for retargeting. This means their spend on paid channels is focused more on retargeting users instead of building a full funnel.

Since LinkedIn ads are much more expensive than Facebook ads, we can assume that a part of their budget is dedicated to reaching new audiences (retargeting ads on LN are just not worth it)

Organic social media

Most of the social media traffic comes from Twitter, LinkedIn and Discord.

Types of posts published:

Reposts of useful tips

Webinar promo

Threads with useful tips

Top 2 takeaways for acquiring customers

Build a strong brand to optimize ad spend

Since 8fig is a recognizable brand within its category, they receive a lot of direct traffic and organic search for brand keywords. Therefore, their strategy doesn't need to focus on leads from webinars, which require more nurturing before they're ready to sign up. This helps them get more direct signups and drives down their cost per lead.

Enable leads to self-qualify

Qualifying leads usually relies on a complicated system that is prone to over or underestimating the quality of leads.

However, 8fig found a way around this process by enabling users to self-qualify through a series of questions. Although this may create friction during the signup process and lead to fewer inquiries, it ensures that everyone who signs up is easily qualified as someone who's worth 8fig's time. It also gives leads a chance to see whether they're ready for 8fig's solution.

Comentarios